From code to market: Network of developers and correlated returns of cryptocurrencies

Code has become an important societal regulator that challenges traditional institutions, from national laws to financial markets. A new research paper, coauthored by FBK researchers Lorenzo Lucchini and Bruno Lepri, has been published on Science Advances

Complexity surrounds us and we always feel astonished when links between different realms of our reality are found. Can you foresee a connection between crypto-developers and investors? It could sound strange, but there is one, and here it is.

The implications of this connection are concerning, in particular, for those investors who pretend this digital ecosystem to work “bit-by-bit” instead of as a more complex entity.

It’s about crypto but the implications are broad, investing any code-based socio-technical system.

“Code is law” is the founding principle of cryptocurrencies.

The security, transferability, availability, and other properties of crypto-assets are determined by the code through which they are created. If code is open source, as is customary for cryptocurrencies, this would prevent manipulations and grant transparency to users and traders.

However, this approach considers cryptocurrencies as isolated entities, neglecting possible connections between them.

In their research paper, the authors show that 4% of developers contribute to the code of more than one cryptocurrency and that the market reflects these cross-asset dependencies.

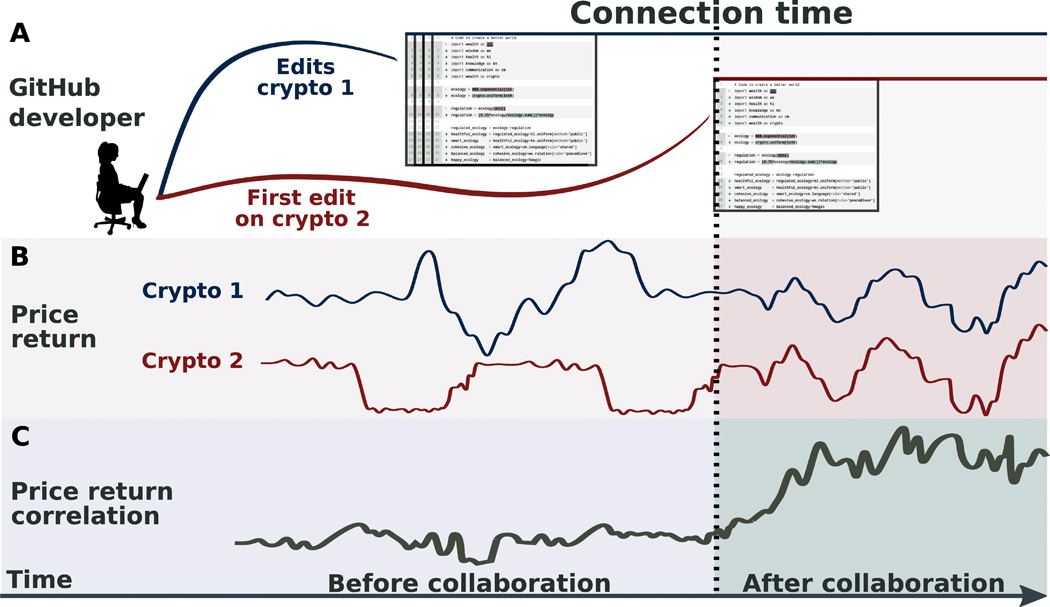

In particular, they reveal that the first coding event linking two cryptocurrencies through a common developer leads to the synchronization of their returns.

Cryptocurrencies sharing common developers show a more similar financial bahviour: returns begin to be more correlated after the common developer give her/his contribution.

The results identify a clear link between the collaborative development of cryptocurrencies and their market behavior. More broadly, they reveal a so-far overlooked systemic dimension for the transparency of code-based ecosystems that will be of interest for researchers, investors, and regulators.

These results have broad implications. “Code has become an important societal regulator that challenges traditional institutions, from national laws to financial markets . In particular, whether and how financial markets and technological code development interact is an open and debated question. The case of cryptocurrencies is paradigmatic and still largely unexplored. Cryptocurrencies are open-source digital objects traded as financial assets that allow, at least theoretically, everyone to directly shape both an asset structure and its market behavior. The open-code paradigm does not automatically translate in a diffuse and complete understanding of the rules of the game. Relying on that assumption can expose investors to risks and threathen cryptocurrency financial stability.”

This study, identifying a simple event in the development space that anticipates a corresponding behavior in the market, establishes a first direct link between the realms of coding and trading. In this perspective, the researchers anticipate that their results will be of interest to researchers investigating how code and algorithms may affect the nondigital realm and spark further research in this direction.