What is a mobile money service? Why is it needed?

Mobile Money: Understanding and Predicting its Adoption and Use in a Developing Economy - our recent case study computed 77 features to investigate whether and how past mobile phone behavior is related to the future usage of M-Pesa

As of today, there are approximately 2 billion unbanked individuals worldwide, adults who are not bank account holders or do not have access to a financial institution. Access to financial institutions is difficult in developing economies and especially for the poor, due to the low penetration of financial services in such countries, particularly in rural areas.

The widespread adoption of mobile phones, including in developing countries, has enabled the rise of mobile money services. Mobile money bridges the gap between the cash and digital economies, enabling those without access to banks to load cash in a mobile wallet and transact digitally using money transfers, deposits and withdrawals of money, bill payments, etc. through the mobile phone network.

In 2007, the largest mobile operator in Kenya, Safaricom (owned partially by Vodafone) launched a new payment and money transfer service delivered through its mobile phone network, known as M-Pesa. M-Pesa stands for Mobile “Pesa”, the Swahili word for money and it is the world’s most successful mobile money service.

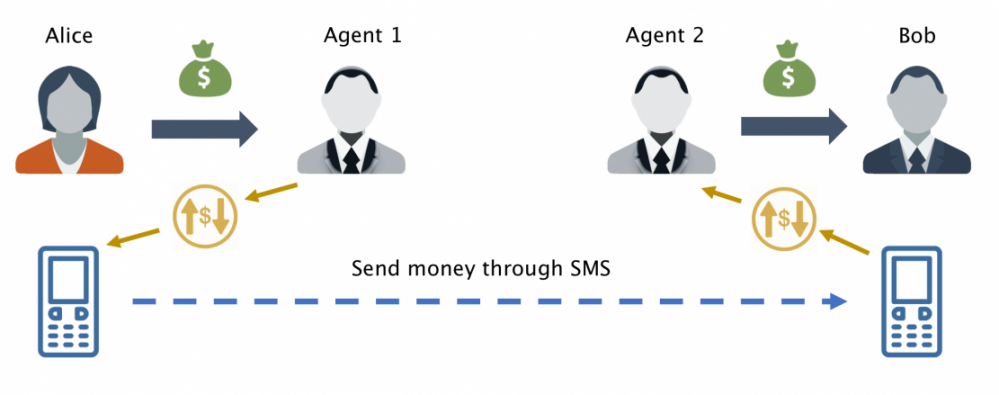

After a simple registration phase, requiring an official form of identification, the service allows its customers to perform a variety of services, including deposit money on their M-Pesa account associated with their mobile phone; transfer money via an SMS to another mobile phone user; withdraw cash from their M-Pesa account; purchase airtime and pay bills. To enable money deposits and withdrawals, M-Pesa runs and maintains an extensive agent network distributed on the territory. In fact, M-Pesa acts as a branch-less banking service where the “ATMs” are replaced by agents, which generally consist of already existing airtime resellers and retail outlets. Here follows an example of a money transfer between two M-Pesa customers.

How does it work?

Suppose Alice and Bob live far from each other and that Alice wants to send money to Bob in a fast and secure way. Alice goes to the M-Pesa agent (Agent 1) and top up her M-Pesa account. Then Alice sends the money to Bob with a specific SMS. Bob can go to the nearest M-Pesa agent (Agent 2) and withdraw the money from his account.

As of today, M-Pesa has grown rapidly and the service is offered in 8 countries: the Democratic Republic of Congo, Egypt, Ghana, India, Kenya, Lesotho, Mozambique and Tanzania.

During his summer internship at Vodafone Research, London, our researcher Simone Centellegher had the possibility to work on the interesting topic of mobile money, that led to the recently published paper called “Mobile Money: Understanding and Predicting its Adoption and Use in a Developing Economy”.

In this work, the authors were mainly interested in understanding whether and to which degree past mobile phone usage captures elements of human behavior that are predictive of future mobile money usage. Moreover, they report the results of the analysis of mobile phone and M-Pesa data from an African country where M-Pesa has the largest market share (42%), in competition with three other mobile money providers. Mobile money is well adopted in this country which has an estimated poverty rate of 47%, with about 12 million people still living in extreme poverty and many others living just above the poverty line. Taken together, these aspects make the country under study an interesting candidate to analyze mobile money services.

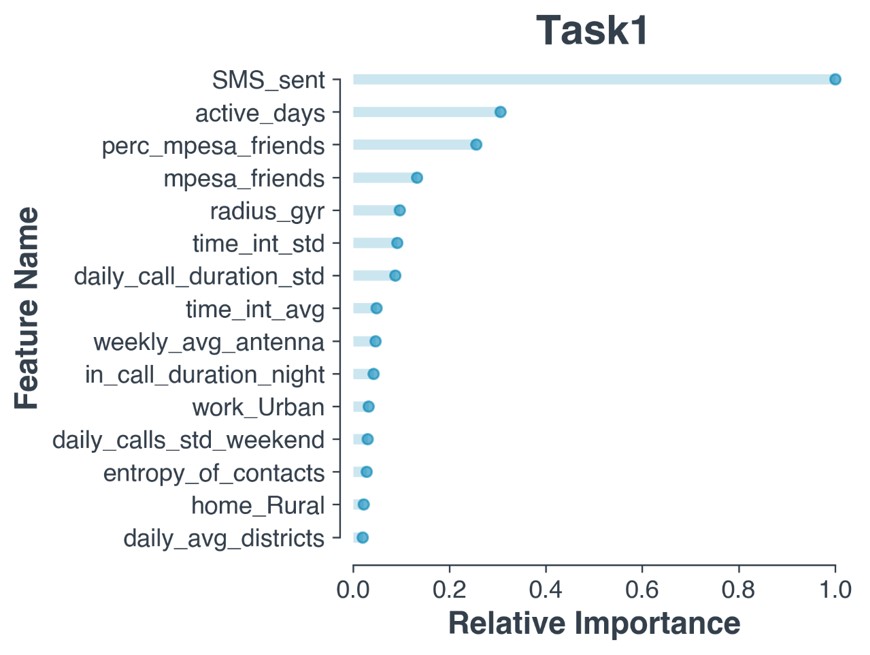

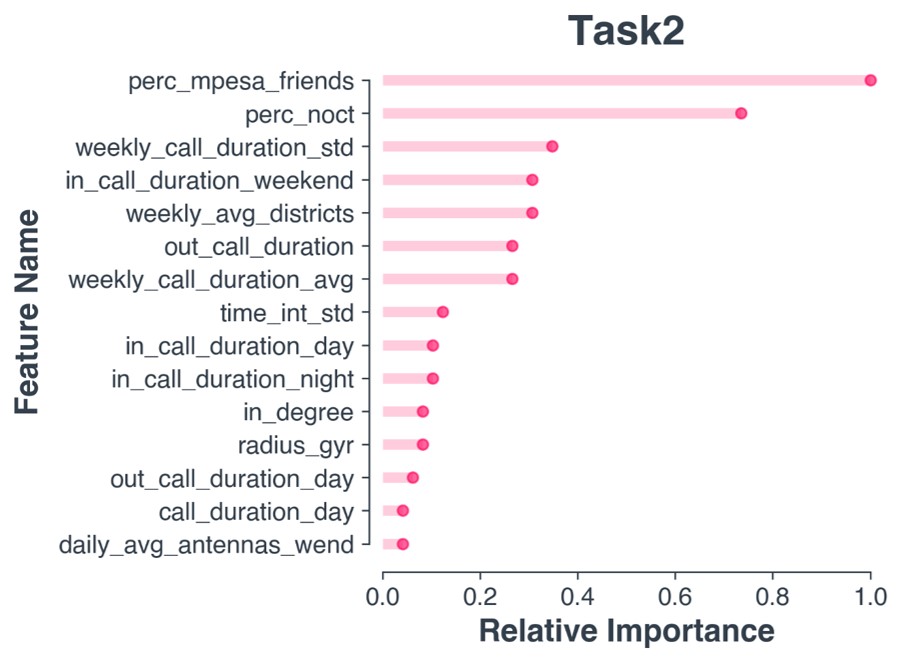

They used two datasets containing mobile phone communications and mobile money transactions of an African country from two different time periods. They then used this data to build two machine learning-based predictive models that predict future M-Pesa adoption and intensity of usage, using multiple sources of data, including mobile phone data, M-Pesa agent information, the number of M-Pesa friends in the user’s social network, and the type of geographic location where the mobile activity took place. The main families of features extracted are the following:

- Mobile usage: e.g. active days, number of calls, percentage of nocturnal calls, etc.

- Mobility: e.g. number of visited antennas, number of visited districts, radius of gyration, etc.

- Agent network: number of agents in a 500m radius, minimum distance to an agent

- Ego network: e.g. degree, number of M-Pesa friends, percentage of M-Pesa friends

- Location characterization: home and work location characterization (rural/suburban/urban)

Predicting M-Pesa usage and spending

The two datasets were collected in different time periods: from November 2016 to January 2017, and from April 2017 to June 2017 (three months later). Hence, they computed 77 features to investigate whether and how past mobile phone behavior is related to the future usage of M-Pesa.

Main results

Despite the limitations of avilable dataset, represented by the random sample of customers and a 3 month gap between the two datasets, they found some interesting insights:

- The most predictive features are related to mobile phone activity (e.g. SMS_sent, active_days) and to the presence of M-Pesa users in a customer’s ego-network. Thus, they observed a relevant level of social virality in the likelihood of using M-Pesa.

- Surprisingly, in the top 15 most predictive features of our models, they did not find features related to the distance and density of agents.

- Findings and models also have business value as they enable mobile money service providers to better identify potential new customers of their services, anticipate consumption and understand the key drivers for mobile money adoption and usage.

The work with Vodafone Research on the M-Pesa data is part of two very relevant research areas for the Mobile and Social Computing Lab (Mobs @ FBK):

- Data Science for Social Good

- Digital Finance

In the field Data Science for Social Good the group is active, in collaboration with MIT, Vodafone Research, Data-Pop Alliance, in several projects that have the purpose of using big data to monitor the achievement of sustainable development goals.

As regards Digital Finance, the MobS group is active in the development of algorithms that use traditional sources (payments) and alternatives (data from telephony, social media) of data to assign credit score scores to individuals with little or no bank history and to small and medium-sized businesses. Also in this area the group is also working on behavioral models that can explain the use of cryptocurrencies.