Matching family savings to increase college education

IRVAPP researchers describe the college savings accounts programs and present the promising results of a pilot project they have evaluated

In Italy, less than 20% of the population has a university degree. Not only does our country rank second-to-last in Europe for its graduation rate, but it also shows record figures in social disparities: a child of graduates has a two-times lower chance of obtaining a degree than the child of non-graduates. The system supporting the right to study – based on scholarships and exemptions from taxes – is not enough to cover the costs faced by families. Furthermore, the decisions on scholarship eligibility, as well as the actual disbursement of the scholarship, takes place too late, after enrollment, i.e. when the families have already made their choices.

A recent study conducted by FBK-IRVAPP researchers was published in the Journal of Policy Analysis and Management and provides supportive evidence that helping low-income students save can help them attend college.

Children’s Savings Accounts

A possible solution to ensure fair access to higher education is represented by the so-called Children Savings’ Accounts (CSA), or incentive savings accounts for education. CSAs are financial instruments designed to support higher education investments for low-income families. They are opened at birth or in the first years of life and require that families make regular small payments into a dedicated account and that these savings are multiplied (or incentivized with other forms of financial support) provided that the money is spent on the education of children.

The aim of this type of support actions is, on the one hand, to favor the accumulation of financial resources invested in education, on the other, to strengthen family aspirations and expectations regarding the education of their children.

CSAs have been designed based on the experience of Individual Development Accounts and today they are popular in the US, but also in other countries, such as Canada, Singapore, Korea and Israel. Some experiments have also been started in Italy in recent years. Two in particular. And in both, FBK, through IRVAPP, plays the role of the evaluator. The first one, which we talk about in this post, is called Percorsi. The second one, WILL, is in full swing.

Percorsi

Percorsi is an incentive-saving program created by the Ufficio Pio [the Office for the support of unpriviledged families] of Compagnia di San Paolo, aimed at promoting college education for students from low-income families attending high school in the metropolitan area of Turin.

How does it work?

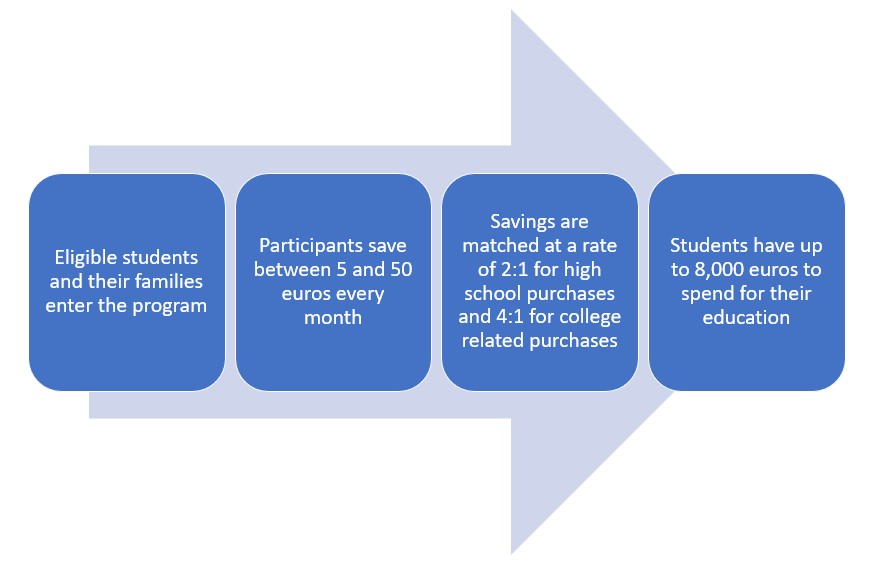

Families participating in Percorsi are required to regularly pay in small amounts of money in a dedicated savings account. The strong incentive to save consists in the match rate, which multiplies the savings by 4 if they are used to buy products or services for college, or by 2 in the event that the expenses are incurred during high school. Each family is allowed to save a maximum of up to €2,000, benefiting from a maximum match of €8,000. In addition, the family is required to take financial education courses.

Figure 1 – The logic of the program

Percorsi has led to a marked increase in university enrollments

The evaluation of Percorsi, called ACHAB (Affording College with the Help of Asset Building) (was made possible by European funding and was carried out by FBK-IRVAPP and ASVAPP between 2014 and 2017.

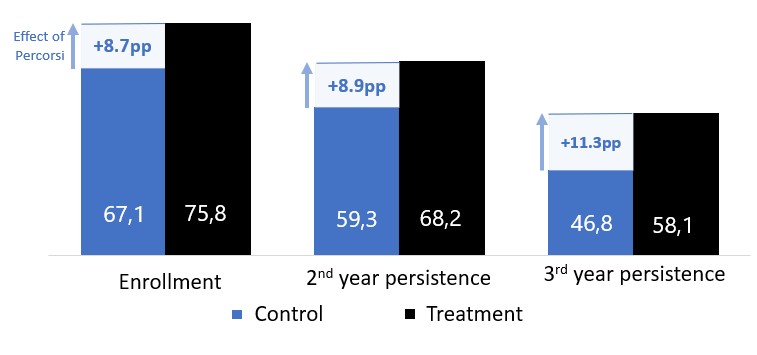

The study involved 700 students and was conducted using a randomized controlled trial. The results published in the Journal of Policy Analysis and Management show unequivocally that Percorsi had a substantial impact on the likelihood that students would enroll in the first year of university (+8.7%) and that this positive result has been maintained over time: the impact on enrollment in the second and third year was 8.9 and 11.3% respectively.

Figure 2 – Percorsi increased college enrollment and persistence

In particular, it was found that the effects have been significantly larger for vocational school students – students with a lower academic background and a more disadvantaged socio-economic status.

Lessons learned

The support offered by Percorsi has reduced the costs incurred by families, allowing students not to have to work to finance their studies, with consequent performance improvement.

The availability of financial resources dedicated to education expenses raised and strengthened the educational expectations of families who, in the absence of the program, would not have considered enrolling their children in college.

The incentive offered by Percorsi also allowed low-income families to save considerable amounts for their children’s education related expenses (on average in the first 4 years they saved 1,080 euros).

However, it is of critical importance that these tools are designed in a progressive way, i.e., characterized by effective support and incentive mechanisms so that even the most disadvantaged families can fully benefit from them.

Conclusions

An increase in education levels in the Italian population cannot be achieved but through a strong expansion of the enrollment in higher education programs on the part of students from low-income families, who, in our country, show very low enrollment rates.

Savings incentive programs such as Percorsi have the potential to integrate current financial instruments (see Diritto allo Studio in Italy) aimed at reducing social disparities in enrollment in higher education.

Further research is necessary to broaden the empirical evidence base on which effective large-scale action programs can be built.

Published article:

Alberto Martini, Davide Azzolini, Barbara Romano, Loris Vergolini (2020), Increasing College Going by Incentivizing Savings: Evidence from a Randomized Controlled Trial in Italy, Journal of Policy Analysis and Management, DOI: 10.1002/pam.22260